Health Resources

News and tips to keep you healthy, including advice from Crozer Health physicians and experts.

It's important to stay informed and educated about your health in order to maintain a healthy lifestyle. The resources below will help you to learn more about your health, identify Crozer Health services to help you maintain your health and find the right providers to guide your healthcare experience.

Articles

Bolstered by Her Family’s Kindness and Support, Cathie Overcomes Breast Cancer

Energetic, humorous and highly dedicated to her family and friends, Cathie Fasciglione always took her health seriously. “I’ve been with Crozer Health for 20 years or more,” she recalled.

Risk-Reducing Surgery Turns into Much More

Chris Clifton, a dental hygienist for 37 years, was diagnosed with ovarian cancer at age 47. However, it did not happen in the usual way. “I was diagnosed with cancer while on the operating table having elective surgery,” Chris explained.

A Fashion Designer Is Grateful for the Power of Love to Overcome Pain

Pierre Espinal is an entrepreneur and successful fashion designer in his thirties, and incredibly thankful for the healthcare team at the Crozer Health Burn Center.

Crozer Health’s transplant team gives kidney patient a second chance at life

Crozer Health’s experienced and highly skilled transplant team offers a compassionate, multi-disciplinary approach to organ transplant and patient care. Watch here how they recently gave kidney transplant patient Jennifer Hookey a second chance at life, thanks to a living donor.

Heart and Brain Health: Perfect Together

Did you know that what’s good for your heart also will help keep your brain sharp?

“The link between heart and brain health makes sense,” says Kirankumar Patel, D.O., primary care provider with Crozer Health. “Both organs rely on your body’s network of blood vessels, which fuel them with energy from the food we eat and oxygen from the air we breathe. When you control conditions like high blood pressure, diabetes, obesity, and high cholesterol, you reduce your heart disease risk and improve your brain health, too.”

When to Visit the ER, Urgent Care, or Primary Care Provider

If you’ve ever wondered whether to go to an emergency department (or ER), urgent care, or your primary care provider, you’re not alone. In order to make an informed decision about what location is the right place to go, it is important to listen to your body and assess the severity of your symptoms. Many mild illnesses and injuries can be managed without an emergency department visit.

With Determination to Get Healthy and the Help of Bariatric Surgery, Amy Menginie Has Her Life Back

With determination to get healthy and the help of bariatric surgery, Amy Menginie has her life back. With a personalized two-part surgical plan including both gastric sleeve and gastric bypass, Amy has lost over 300 pounds.

Type 2 Diabetes: Preventing the Silent Disease

Type 2 diabetes is a sneaky disease. Symptoms can be so mild or nonexistent that many people don’t know they have it until they get a blood sugar test as part of a routine checkup. If left uncontrolled, this “silent disease” can lead to heart disease, stroke, kidney failure, blindness, and more.

Life-Saving Advice: How Beth’s Lung Cancer Screening Led to Renewed Health

Beth never thought she needed a lung screening. A friend's urging changed her mind and saved her life.

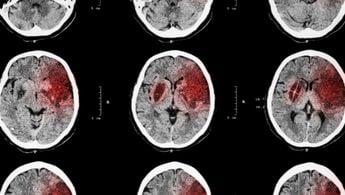

A Conversation with Mandy J. Binning, M.D., FAANS

Dr. Mandy Binning, Chief of Vascular Neurosurgery and Director of Stroke Programs for Global Neurosciences Institute, discusses stroke risks and treatment.

Crozer Health Launches Emergency Medical Services Training Institute

Crozer Health recently received approval from the Pennsylvania Department of Health to launch the Crozer Health Emergency Medical Services Training Institute.

Crozer Health Announces Breast Cancer Team Appointments

Chantal Reyna, M.D., has been named Chief of Breast Surgery & Medical Director of our Breast Program, and recently added Breast Surgical Oncologist, Jandie Schwartz, D.O. to the team.

Hernias: What Are They and How Are They Treated?

Knowing what to look for can help you recognize when you may have a hernia. Contact our hernia experts today.

Crozer Health’s Sports Medicine Physicians Can Help You Stay in the Game

Learn how Crozer Health’s Sports Medicine physicians can help everyone, not just professional athletes.

Our Women’s Behavioral Health Services

Crozer Health offers customized behavioral health programs for expectant mothers who are struggling with substance abuse or addiction and for women who have experienced the loss of a pregnancy or death of an infant.

COVID-19’s Impact on Mental Health

The COVID-19 pandemic has had a major effect on all of our lives, and it can be overwhelming at times. Social distancing and fear have left many people feeling lonely and isolated, which can increase stress, depression, and anxiety. If you or a loved one are struggling with mental health issues, it’s important to get help.

Rebuilding the Burned Bridges with Nutrition

The Nathan Speare Regional Burn Treatment Center is the only burn facility in suburban Philadelphia providing comprehensive treatment for pediatric and adult burn patients and their families. Registered dietitians at Crozer Health play an essential role in patients’ recovery from burns.

Happy, Healthy Holidays

Tips for eating healthy while still enjoying the flavors of the holidays.

Healthy Attitudes—and Dishes—This Thanksgiving

With Thanksgiving fast approaching, dietitians are flooded with questions about how to approach the infamous high-calorie, high-carbohydrate turkey dinner.

Taking Care of Your Mental and Emotional Health in the Age of COVID-19

As we try to adapt to these new dynamics, remember three things: perspective, patience and persistence. Maintain perspective when you start feeling overwhelmed or victimized. Exercise patience when you find yourself in new and uncomfortable situations. And always persist, because every tomorrow is one step closer to conquering this challenge.

The Do-Anywhere, Total-Body Workout While You Shelter at Home

For those of you spending your days at home, following Pennsylvania’s shelter-at-home mandate, it’s important to stay active. You can’t go to the health club, but you can get great benefits from some simple exercises.

Quick Thinking and Teamwork Save Mother and Baby

Lisamarie Poehlmann woke around 2:30 a.m. with what she thought was terrible gas pain. She climbed out of bed and tried to walk it off, but as the fog of sleep faded and the pain intensified, she knew it wasn’t gas.

Poehlmann’s thoughts jumped next to her baby—she was 36 weeks pregnant with her fifth child. “I’ve gone through natural childbirth, and this felt like the worst contraction I’d ever had,” she said. “But I was really confused at that point, because I was thinking there was no way I slept through the start of labor.”

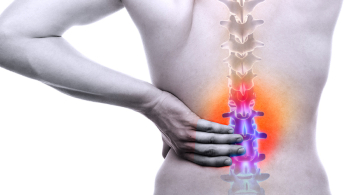

Minimally Invasive Spine Surgery: An Opportunity for Fast Recovery

Twenty-four hours after Rich got a lumbar MRI, his primary care doctor said, “So, we have a problem.” The results were clear, and the MRI immediately explained nearly two years of pain, numbness, tingling and burning from hips to knees. “Severe spinal canal stenosis,” said the MRI report. “Clumping of the cauda equine nerve roots?” He didn’t really know what that meant, and she tried to explain it to him, but ultimately she told him to make an appointment with a neurosurgeon, without delay.

Your Diet May Be Irritating Your Bladder

Some of your favorite foods and drinks could be putting you at risk for developing bladder control problems.

With New Evidence, Stroke Care is Coming into Focus

A landmark study has ignited a dramatic shift in stroke care over the last two years, removing much of the ambiguity that had long surrounded one of the primary treatments.

Make this Year’s Resolution the One that Sticks

With the start of a New Year comes the opportunity for a fresh start. It’s only human to want to improve ourselves, and it’s all the more enticing when our family and friends are doing it, too.

Main Line Today Top Doctors Survey Honors 105 Crozer Health Physicians

Main Line Today posted its “2019 Top Doctors” this month, which is derived from an online survey that asks physicians who they most trust. In this year’s results, 105 Crozer Health doctors were voted onto the list, including six who received the most votes in their specialty.

What are Your End-of-Year Health Care Priorities?

Coordinate with your doctor and your insurance company.

Partnership Helps Catch Diabetic Retinopathy

With the intent to catch diabetic retinopathy (DR) in its earliest stages, primary care practices in the Crozer Healthhave partnered with a regional ophthalmology practice and a national medical devices and software provider to screen patients quickly and easily.

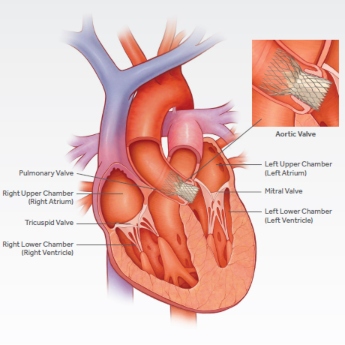

TAVR Revolutionizing Treatment of Aortic Valve Disease – Now at Crozer-Keystone!

The name of the procedure is a mouthful, but the impact it’s having on patients is huge. It’s called transcatheter aortic valve replacement—TAVR for short—and it’s revolutionizing how patients with aortic valve disease are treated at Crozer Health .

Holidays and Hospice: Making Time Count

The holidays are supposed to be a time of happiness and joy. This can be a challenge when a loved one is terminally ill.

Beware the GI Effects of ‘Overindulgence Season’

The holiday season could just as accurately be called the “overindulgence season,” especially when it comes to food and drink. From Thanksgiving through New Year’s, this time of year can lead to more gastrointestinal issues than usual, including heartburn and acid reflux.

Don’t Let Thanksgiving Dinner Throw You Off Track

The average American consumes an eye-popping 3,000 calories at Thanksgiving dinner alone. Add in appetizers, drinks and dessert and the total can swell to 5,000 calories. That’s double or even triple the recommended caloric intake for an entire day.

While those number are sobering, one Crozer Health dietitian says it’s important to put this calorie bomb into perspective.

Why You Should Embrace the Cold if You Exercise Outdoors

Exercising outdoors, whether running or hitting a garage gym or engaging in countless other activities in between, can be a liberating experience. No commute to a fitness center, no lines for equipment, and no distractions. But it can also be a challenge between the first frost and first lasting thaw.

How a Chronic Wound is Diagnosed and Treated

Nearly seven million Americans suffer from chronic, or non-healing, wounds associated with conditions such as diabetes, peripheral vascular disease, and autoimmune disease. Treatment of wounds at Crozer Health is a team-oriented, multidisciplinary approach that’s focused on speeding up the healing process, preventing a recurrence, and improving the patient’s quality of life.

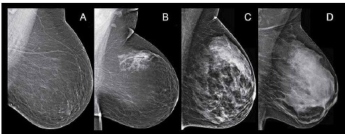

The Art and Science of Recognizing Cancer in Dense Breast Tissue

Nearly half of all women age 40-and-older have what are considered dense breasts, according to the National Breast Cancer Foundation (NBCF), which published a free Dense Breasts Guide to coincide with Breast Cancer Awareness Month. Find out more about the art and science of recognizing cancer in dense breast tissue..

Have You Had Your Flu Shot Yet?

Flu season is upon us—which means you’ll need a flu shot this fall if you haven’t already gotten one.

But getting a flu shot isn’t a guarantee that you won’t get the flu. So, how much does it help, then?

Healthier Ways to Halloween

The few houses that dared to give out apples or small boxes of raisins on Halloween were usually bypassed the next year. But that’s changing as society becomes more informed about the detriments of poor eating habits.

How to Curb Your Child’s Sugar Intake on Halloween

The average trick-or-treater in America will consume around three cups of sugar (or about 7,000 calories of candy) on Halloween, according to one industry report.

Buried beneath that mountain of sweets is an already pressing concern about the amount of sugar Americans (kids and adults alike) eat on a daily basis, the growing research that suggests that excess added sugar in the diet has strong links to cancer, and the already strong ties to obesity, diabetes, and heart and other cardiovascular diseases.

70 Pounds Lost Since Surgery… and Counting

At 57, Susan Birkinbine had spent much of her life concerned about her weight and tried lots of different things to control it, none to any effect. Following the recommendation of a few of her coworkers, last February, Birkinbine met with Aley E. Tohamy, M.D., FACS, a bariatric surgeon with the Crozer Health .

Crozer Health in the News: Urogynecologist Offers Sage Advice

Main Line Today consulted six local experts in an effort to pinpoint the necessary tools to improve one’s self-image, relationships, and career. The resulting article, which features Cynelle Kunkle, M.D., a urogynecologist at Crozer-Chester Medical Center, appears in the October 2019 issue.

U.S. News & World Report Names Crozer Health Hospitals Among the Best in Pa.

Crozer Health ’s hospitals have been recognized by U.S. News & World Report for high performance this year. The annual Best Hospitals rankings and ratings, now in its 30th year, are designed to help patients and their doctors make informed decisions about where to receive care for both challenging health conditions and common elective procedures.

As Health Care Becomes More Fragmented, Family Doctors Take the Reins

“For someone who has complex health needs, it’s very easy to get lost in today’s health care system,” said William J. Warning II, M.D., director of the Crozer Health Family Practice Residency Program. “With each referral, you become another degree removed from your primary care physician. Without a clear diagnosis, how are you supposed to know where to turn next?”

How to Spot a Concussion in Kids and Teens

With scholastic sports and community leagues kicking off their fall seasons this month, the topic of concussions is common again.

“The majority of the concussions we see are in adolescents,” said David Baxter, D.O., a sports medicine doctor in the Crozer Health .

Crozer Health Providers in the News

A new article on the healthy-living site Livestrong.com and another in the September-October issue of Chester County Life feature Crozer Health health care providers who are sharing sage advice.

Danielle Lockard, R.D., an outpatient dietician at Springfield Hospital, weighs in on how to snack wisely during a demanding hike in the Livestrong.com article, “Best Hiking Snacks That Keep You Energized on the Trail.”

The Good News About Pelvic Organ Prolapse – It’s Treatable

Pelvic organ prolapse is a problem that many women have, but few want to discuss. That’s largely because of the varying, though embarrassing, symptoms that can accompany it: a bulge in the vaginal area, problems with intercourse or using tampons, difficulty exercising or walking, and the inability to empty the bladder completely.

A Proactive Approach to Hernia Repair

Hernias were once considered just a hole in the abdominal wall that required a simple repair. But research during the past several years is now showing that it’s not always so straightforward.

Private Inpatient Rooms a Benefit to Experience and Outcomes

Private hospital rooms have long been considered a luxury by patients and health care employees alike. But research now shows that having a private room during a hospitalization is more than a nice perk…it can actually promote healing.

When to See a Doctor About Your Sunburn

Irritating as it can be, much of the pain and tenderness of a sunburn can usually be relieved with over-the-counter treatments and simple first aid. In extreme cases, however, a visit to a specialist may be warranted.

Crozer Health and Philadelphia Union Welcome Fans for Life

All babies born at Crozer-Chester Medical Center or Delaware County Memorial Hospital on Union game days will receive a “Philly Born” onesie, a certificate, and three non-expiring tickets to a future Union game.

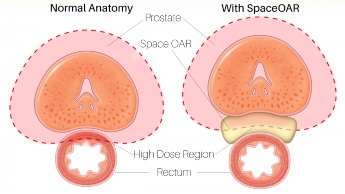

Gel Spacer Improving Prostate Radiation Therapy Side Effects

Radiation treatment for prostate cancer is potentially damaging to surrounding organs and tissue. A gel-like material called SpaceOAR is being used at Crozer Healthto temporarily distance the prostate from the rectum. This dramatically improves some significant side effects for men who undergo prostate radiation therapy.

Crozer Health 's Inpatient Rehab at Taylor Hospital

The inpatient acute rehabilitation unit at Crozer Health ’s Taylor Hospital in Ridley Park, Pa., is now more capable than ever thanks to its new partner, Kindred Healthcare. Kindred is renowned nationally for expertise in long-term post-acute care.

Preventive Medicine and Annual Checkups

Making time for your routine checkup is extremely important for your overall health. The regular health exams and tests performed during routine checkups can help identify risk factors and problems before they start.

How to Manage Your Blood Pressure

Learn what causes high blood pressure, who is most at risk and how you can maintain or lower your blood pressure.

Why Does My Knee Hurt?

The knee is vital for movement and is in constant motion from the moment we arise to the time we go to bed. Because of this, the knee is vulnerable to injury. Sudden twists and turns can strain or tear many of the structures within the knee.

How to Quit Smoking

How to Prepare for a Race

Training for a run is fun, exhilarating—and if you’re a newcomer, potentially daunting. It may be a race, but Crozer Health’s sports medicine specialists recommend, above all, taking it slow.

Preparing for School Sports

High school athletes account for an estimated 2 million injuries, 500,000 doctor visits and 30,000 hospitalizations each year. But there are measures student-athletes can take to prevent injuries, including physical exams, strength conditioning, warming up adequately and proper nutrition.

Urgent Care or Emergency Department?

Between retail clinics, urgent care centers and emergency departments, you have a lot consider for where and how to get immediate treatment.

How to Treat a Burn

If you or a family member suffers a burn, there are some immediate steps you can take to ensure proper care is received.

How to Choose a Primary Care Provider

If managing your health were a business, your primary care provider (PCP) might be considered the president and CEO. This is the person who oversees the big picture and keeps a steady eye on the bottom line — keeping you healthy.

What Causes Dizzy Spells?

Dizzy spells are common and can be caused by dehydration or low blood sugar. However, there are instances in which dizziness occurs as a result of certain diseases.